Which Drives Greater Loyalty?

Loyalty programs are a cornerstone of customer engagement, but which rewards structure truly fosters long-term retention—cash back or experiential rewards? In our latest webinar, Sarah Cole and David Hinkemeyer explored this critical question, diving into consumer spending behaviors, reward preferences, and the psychological drivers behind different redeemer types.

Key Takeaways from the Webinar

Cash back remains one of the most universally appealing incentives in loyalty programs. Consumers are drawn to its simplicity and the immediate financial benefit it provides. In fact, 62% of consumers prefer cash back offers when selecting a credit card or banking product, making it a go-to choice for financial institutions looking to attract new customers. However, while cash back offers quick and tangible rewards, these programs often experience higher attrition rates, ranging from 10-15% annually. The challenge for brands is ensuring continued engagement beyond the initial appeal of instant savings.

On the other hand, experiential rewards—such as travel perks, exclusive events, and unique lifestyle experiences—tend to create stronger emotional connections with consumers. Programs that offer aspirational rewards encourage long-term engagement, with data showing that points-based programs featuring travel or experience-driven incentives have lower annual attrition rates of 5-10%. Consumers who save points for larger redemptions often spend more per transaction and maintain a deeper connection with the brand over time. The emotional impact of these redemptions helps build lasting loyalty, making experiential rewards a powerful strategy for sustained customer engagement. Check out some real life redeemer activity below! (identities have been changed to maintain privacy)

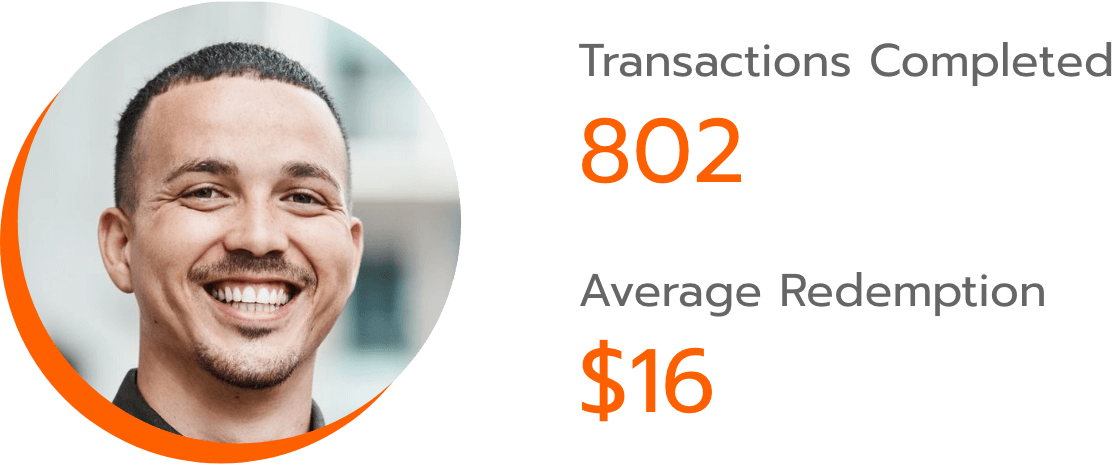

Dan

The Frequent Cash Back User

Dan maximizes his Cash Back Card with small, frequent redemptions, averaging $16 per redemption, to offset daily expenses. With 802 transactions and $49,519 in annual spend, he stays consistently engaged, using his rewards as a strategic budgeting tool.

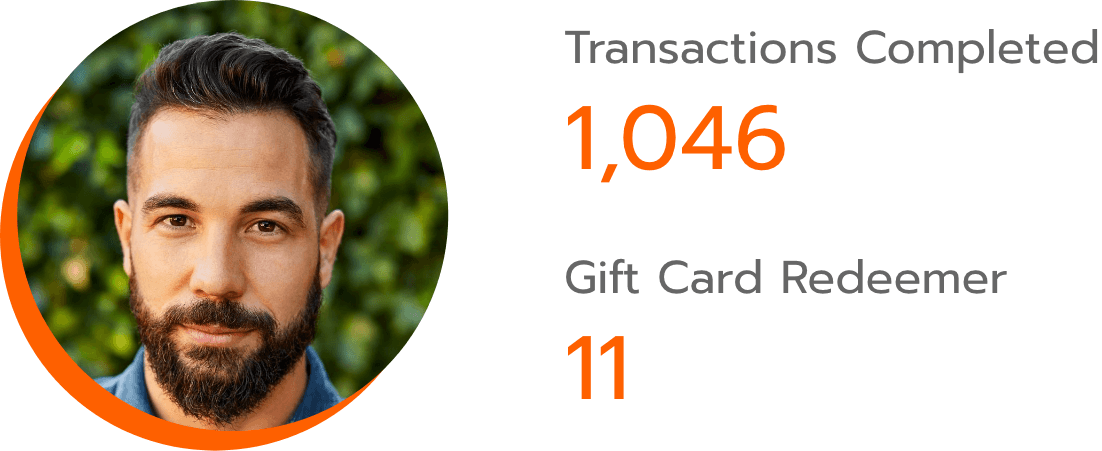

Alex

The Lifestyle Optimizer

Alex integrates his Visa Platinum Card into his daily routine, using it for subscriptions, groceries, and essentials, accumulating 1,046 transactions and $37,049 in total spend. He redeems rewards for Amazon and Home Depot gift cards, balancing everyday purchases with valuable redemptions.

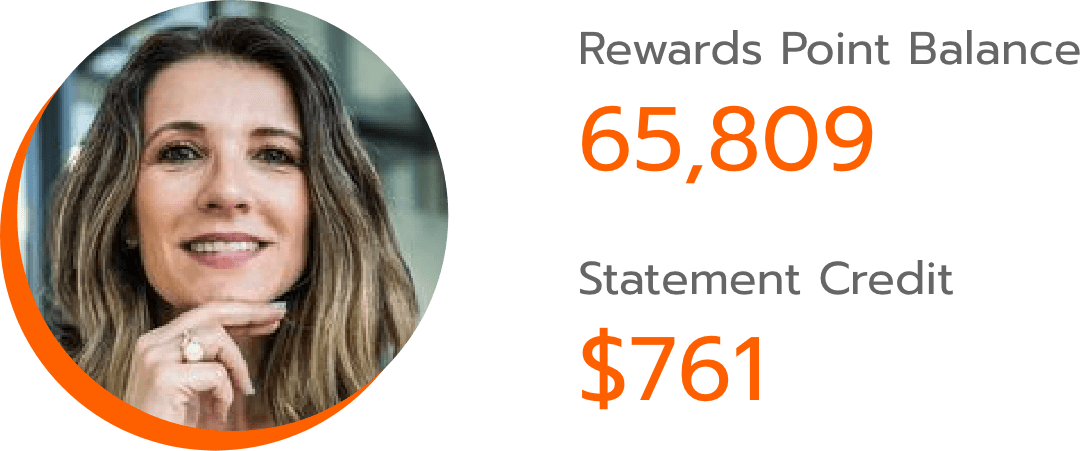

Lisa

The Careful Saver

Lisa patiently builds up her rewards balance, making a single large redemption of $761 in statement credit after months of saving. With 237 transactions and $9,797 in spend, she strategically manages her rewards to maximize long-term financial benefits.

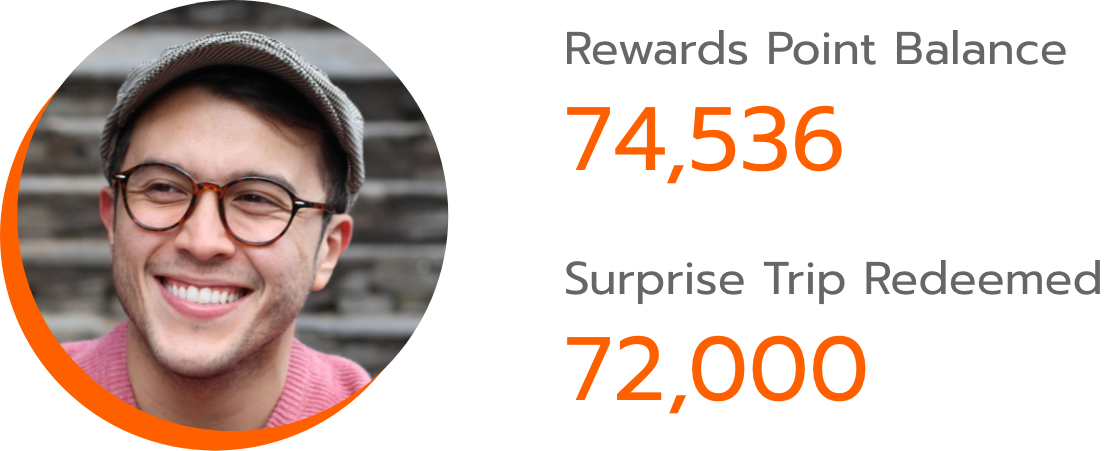

Jake

The Big Reward Planner

Jake earns 74,536 points and strategically redeems 72,000 points for a surprise anniversary trip, prioritizing memorable experiences over frequent redemptions. He continues to accumulate points for future high-value rewards, ensuring his spending leads to meaningful perks.

The right rewards strategy depends on your audience, but data suggests that while cash back provides instant gratification, experiential rewards cultivate deeper loyalty and higher lifetime value. Want to learn how to craft a winning rewards program?

Watch the Webinar